Blogs

GIVE IT TO ME NOW!

Every Decision Is A Retirement Decision DELAYED GRATIFICATIONThat really is the question that drives everything when we are talking about Saving, and we don’t care what youa re saving for; new home, upgrade your car, education or retirement. Can I hold off and not spend today, so that I will…

Annuities Are Bad

Actually it should be phrased “Are Annuities Bad”? Annuities are bad, at least that’s what everyone says…right?Let’s start with what an annuity is: An annuity is a series of payments made at equal intervals for a set period of time. What are examples of an annuity? Social Security is one.…

Time Value of Money

The Opportunity Cost of Money TIME VALUE OF MONEYFor most of us this tends to cause our eyes to glaze over whenever someone starts to go into the details around this subject. It breaks down into 2 parts;PART A – The money you have today is worth than the money you…

Talking to Kids About Money (part 1)

At What Age Should I Start The Conversation? Research shows that kids can start learning about money as early as Age 3 and the more often you have those conversations with them the better they fare later in life, so let’s get things started. WHY 3? Here’s what they can do at…

Talk to Your Kids About Money (Part 2)

HELPING YOUR CHILD BE SMART WITH MONEY We all know that the earlier you start learning a language, the easier it will be to master it. Learning any foreign language at the age of 4 is much easier than at the age of 40. The same applies to managing your…

Social Security Claiming

AT WHAT AGE CAN I CLAIM SOCIAL SECURITY? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Talk To Your Kids About Money (Part 3)

LEAD BY EXAMPLE As a parent, I believe, that the number 1 goal we have for our children is that they grow up to be healthy and responsible adults. That we have taken the time to teach them good values, the difference between right & wrong, and to be a…

Is Cash Really Still the King

Cash vs. Credit – Who Wins This Battle? This is to be a 5 Round Challenge In this corner we have the reigning long-time king of the ring – CASH, In the other corner we have the new up-and-comer CREDIT. We will be judging each round and then announcing the…

Paying For Your Phone WIth A Plan

EVEN A LITTLE DEBT ADDS UP QUICKLY… BUYING YOUR PHONE ON A PAYMENT PLAN When you buy your phone on a paymnet plan you are putting yourself in debt. Let’s say you buy a $1,000 phone and you paid the tax upfront, you now owe $1,000, even if that’s split up…

Renting vs Buying A Home

Pro’s & Con’s and Which Makes Sense for You Is buying a home right for you? Should I rent or buy a home? It’s not an easy question to answer, and there’s a lot to take into account when weighing such a big decision. Regardless of your financial situation, renting…

PUA & TAXES

The American Rescue Plan and Filing PUA Taxes Here’s how it affects PUA: Pandemic Unemployment Assistance (PUA) now runs through the week ending September 4, 2021. Do I automatically get the extension?You can or will depending. The best thing to do is to continue to file your weekly certifications. You should see…

Life Insurance

5 THINGS ABOUT WHOLE LIFE INSURANCE Are you struggling to figure out if whole life insurance is a good product for you to buy then here are five benefits to help you make that decision benefit #1 CONTROL – is control when you have a whole life insurance product you are signing…

What’s In Your (Bitcoin) Wallet?

How Do Cryptocurrency Wallets Work, Anyway? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

What is Cryptocurrency?

You Can’t Help But Hear The Hype on Bitcoin It is very difficult today not to have heard of Bitcoin. And by now you’ve probably seen the hype it has had over the last few weeks reaching all-time highs, and then boom! it starts dropping and loses $1,000s of dollars…

SELL IN MAY & GO AWAY (Part 2)

LETTING GO OF A GOOD THING EVERYBODY LOVES A WINNERSometimes having a little too much, especially when it comes to investments isn’t always a good thing. We tend to want to stick with something that is doing well, but is that a suitable approach?Just like about anything else that you…

Negotiating Skills

3 Tips to Improve your Negostiating Skills How can you improve your negotiation skills? Even if you hate to negotiate. Even if you are afraid to get started with it. Even if you have no idea where to begin. We will share 3 TIPS to help you get started. TIP #1…

CREATING WEALTH

7 Thoughts for Creating Wealth Building wealth comes in many different forms, if you plan on a slow & steady accumulation then setting up a savings plan and investing $50 to $100 per month into a Roth IRA. But that is a long, slow ride that takes a lot of…

Creating Wealth at Different Ages

Wealth Building at Different Ages Building Wealth at Different Ends of the Age SpectrumThink about what your life was like 5 or 10 years ago. It probably looked a little different then it does now, right? Maybe you were still in school, or you weren’t married yet and didn’t have…

The Secret Cost of Pets

It Costs How Much To Own A Pet? The Realities Of Owning A PetOK, so cats and dogs have been friends with humanity for tens of thousands of years, and in the early days the relationship was fairly mutually beneficial, the animals got a safer life with plenty of scraps…

Preparing For A Major Purchase

7 QUESTIONS TO HELP YOU PREPARE 7 Questions to Ask Yourself Before You Make a Big Purchase It’s important to make sure that you’re financially ready to make a large purchase–and that it fits in your budget. Everyone hass a different ideda of what qualifies as a big purchase and it…

SELL IN MAY & GO AWAY (Part 1)

WASH YOUR HANDS & (please) TOUCH YOUR 401(k) WASH YOUR HANDS & TOUCH YOUR 401(k)Around this time last year as all of us were settliong in to the beginnings of the pandemic we were parrying the CDC’s catchphrase of “Wash your hands and don’t touch your face” by trying to give a…

Divorce & Special Needs

Divorce & Special Needs – 3 THings to Consider 5 Things to Consider When Divorce Involves a Special Needs Child Custody, Visitation & Support Considerations and a divorce action can be complicated. However, when a child has special needs, those concerns and the decisions that have to be made are all…

Networking: 3 Ways To Start A Conversation

Here Are 3 Ways To Open A Conversation With Anyone The question we get asked often is “How do I start a conversation at a networking event?” or “how do I start a conversation at a bar?”, or maybe “How do I start a conversation at a party?” We spoke in…

Networking: 5 Tips to Help You Networking

Think 5 When It Comes to Networking 5 TIPS TO HELP YOU BE MORE EFFECTIVE AT NETWORKINGIn 2019 (prior to COVID) I went to over 90 in-person networking events. 90! If you travel back in time some 20+ years ago when I started in financial services I couldn’t fathom even…

Charitable Gifting Part 1

Charitable Gift Annuities This week is all about donors. And today is about charitable gift annuities. if you’re thinking that a charitable gift annuity might be right for you, or you’ve been thinking about ways you can make donations, then let’s spend a little time going over the basic of…

The Secret Cost of Pets

Should You Have Pet Insurance? IS PET INSURANCE WORTH IT?Pet insurance is definitely worth it if you have a pet from a breed with a predisposition to chronic illnesses. Generally, the younger your pet when you obtain the insurance, the lower the premiums and deductibles will be. Pet insurance can also…

Creating A Paycheck In Retirement

Begin WIth A Positive Mindset And Plan For Flexibility Don’t Fall for the Law of Scarcity Even the most optimistic person can develop a limiting mindset upon entering retirement, regardless of how much money they have accumulated. What is a limiting mindset? It basically means that you see resources and opportunities…

Taking Your Dream Vacation

5 STEPS TO GET YOU TO YOUR DREAM VACATION Let’s face it, everybody has some place that they dream of going. Right now it may be nothing more than a spot on your bucket list (if you have one). And we know that for some of us the thought of…

Taking Your Dream Vacation

Safety Steps When You Go Away Yay – You’re Going Away!But before we pack up the station wagon and take the family out on the “Holiday Road”, let’s make sure we are prepared. Travel safety begins before you even leave the house. From making sure your home is secure to brushing…

IRA Mistakes To Avoid

SECURE ACT Changes to IRAs You Should Know… The SECURE Act took effect Jan. 1. The changes to IRA provisions, set forth below, may impact any number of types of IRA (e.g., traditional, Roth, inherited, deemed, Simple and SEP). Post-Death Minimum Required Distributions Accelerated—Elimination of the Stretch IRANew Rules: In general,…

IRA Mistakes To Avoid

Required Minimum Distributions(RMDs) & What To Do The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Do I Need A Will?

Who Needs A Will Anyway? WHO NEEDS A WILL?We know what you’re thinking; I’m young and single—I don’t need a Will, right? Maybe. Here’s a quick look at who needs a will and who can get away without one (for now).What does a Will really do?If you pass away and…

Saving vs Spending

Trying to find the balance: Do I spend for today or save for tomorrow? The battle that we wage Should I spend money today (to enjoy life) or save for the future? This is a common dilemma faced by most people. The amount of money you have is (sadly) limited. Naturally, you…

Do I Need More Than A Will?

Other Legal Documents To Consider As Well I GOT A WILL, AM I ALL SET?The short answer is no, probably not. There are some other legal documents that you should have to go along with your Will. A reminder – these documents should be kept in a safe place that…

Life Insurance Explained

Term vs Perm: It’s kind of like renting versus owning Let’s start with the simple premise that no matter who you are, that your life has significant, whether that value is to your family, or to your community, or both. The question is how do you replace that value if…

Life Insurance – Who’s got you covered?

I’m All Set, I’ve Got Life Insurance Through My Employer Benefit Plans Are EssentialThe insurance coverage(s) provided through your employer sponsored benefit plans are important pieces of your financial plan. Think of them as the building blocks of your financial “house” (savings & investments). Without these critical coverages in place,…

Warning Signs of Diminished Capacity

5 Signs To Watch For With Financial Capability Most of us probably think we know what to look for when a loved one is showing the signs of diminished capacity. But have you ever studied the subtle signs that should serve as red flags for you? Now is the time…

Talking To Someone About Dementia Symptoms

6 Tips To Start The Conversation On Dementia With A Loved One For most of us the idea of broaching the subject of possible warning signs of dementia with a loved one is difficult, but for adult children with their parent it can feel overwhelming according to Alzheimer’s Association “…people…

Budget & Cash Flow Strategies

Budget vs Cash Flow – Is There A Difference? What Is Cash Flow Planning?In simple terms, “cash flow” refers to all forms of cash and assets that come and go from anyone. Companies value cash flow because it offers a clear distinction between what they owe and what they’re earning.…

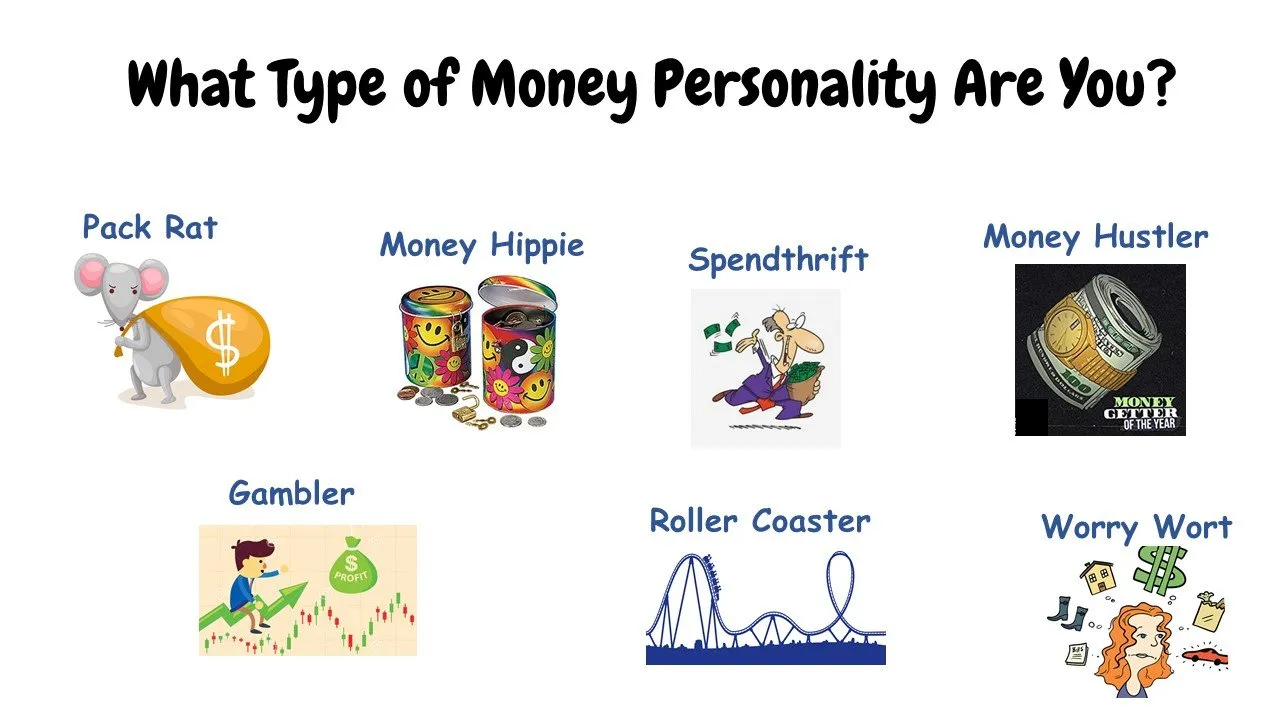

Money Personalties

At ARIES Foundation our mission is trying to help everyone have a better relationship with their money, however when it comes to establishing financial health, one thing most people fail to consider is their money personality type or their approach and emotional responses to money.Part of our concept is the…

Get More FInancial Aid

5 Steps TO Getting More FInancial Aid As the price of a college education continues to soar, most American families find themselves unable to save or put away enough money to meet the rising cost needs. Consider that the average cost for tuition and fees at an out-of-state public university…

Protecting Your Identity

10 Rules to help protect your identity The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

New Scams in 2021

Meet the New Scam, Same as the Old Scam NEW SCAMS IN 2021It certainly seems like that the pandemic and shutdown did nothing to slow down the con artists and fraudsters out there, in fact, it feels like there are more and more scams popping up every week. Let’s take…

Social Security Claiming

Step-by-Step to get your My Social Security Account How do I get a My Social Security Account?It’s very important in the world of senior benefits to have access directly online to what your benefits are going to be in the future, even if you’ve not yet applied, and to be…

Social Security Taxation

This is a subtitle for your new post The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Can I Work & Collect Social Security?

4 Scenarios to help you understand working & collecting When it comes to Social Security benefits one of the top questions that we get asked at the ARIES Foundation is “Can I work and still collect Social Security?” On the face of it, it would seem like working while collecting…

Student Loan Crisis

How Did We Get Here & Who’s To Blame? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Social Security Issues

Are There Fixes for Social Security? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Why Credit Matters

Ways To Build Up Your Credit Score Does having a higher credit score really matter? Well, let’s take a look at some of the things having a higher credit score could do for you. By having better credit, then it is more likely that not only would you be likely…

Why Credit Matters

Why Having Good Credit Is Important The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Life Insurance Q & A

5 REASONS TO CONSIDER HAVING LIFE INSURANCE The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Life Insurance Q & A on Term Coverage

What Is Term Insurance and How Does It Work? What is Term Life Insurance and How Does It Work? Term life insurance, which is sometimes referred to as pure life insurance ensures a payment of a death benefit, if the policyholder dies within a specific period of time. If the…

Estate Planning Documents

4 Must-Have Estate Documents Today’s lesson is about some simple estate planning documents that it would benefit you to get these done now. We have clients coming in to us, generally in their 60s, and a lot of them turning 65, and talking to us about Medicare and then they…

Healtcare in Retirement

Medicare – It Ain’t Free Planning for healthcare costs in retirement. One of the biggest misconceptions that people may have when it comes to healthcare costs in retirement is about Medicare, specifically with the notion that Medicare is free. Which unfortunately, is not true. So what should you be aware…

Why Do Resolutions Fail?

This is a subtitle for your new post Research has shown it is more effective to make resolutions at New Year’s than at any other time of the year. In fact, one study found that people who made resolutions on January 1st were 10 times more likely to…

Financial Goal Tips – Part 1

6 Ideas for Financial Goals Financial goal ideas to start out the new year and some tips for setting them up. There are so many different financial goals that you can set for yourself sometimes it can be fun to just take a look at all the different things that…

Financial Goal Tips – Part 2

Have Some Fun With Financial Goal Setting This part 2 of our blog on financial goal ideas to start out the new year and some tips for setting them up. There are so many different financial goals that you can set for yourself sometimes it can be fun to just…

why-do-we-make-resolutions

Think about why you want to make that goal… Every year, millions of people around the world make New Year’s resolutions in an effort to improve their lives and achieve their goals. But have you ever stopped to wonder why we make resolutions in the first place? There are a…

Set & Keep Your Financial Goals

Steps to take to make your 2023 Financial Goals a Reality! The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Wants vs Needs: Understanding the Difference

As Veruka would say, “I want it now…” In today’s consumer-driven society, it’s easy to get caught up in the idea that we need to have everything we want. However, the truth is that there is a big difference between wants and needs, and understanding that difference can help us…

If you’re only using your TV as a mirror, then we’re probably in a recession… Recessions are a normal part of the economic cycle, but they can be difficult to predict and even harder to navigate. However, there are several indicators that can signal that an economy is in a…

Stay motivated to keep your goals on track The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

9 Tips To Save Money Fast

42% of American Adults have less than $1,000 in savings Whether you’re a home-owner, renting, or living with family members, nearly every American struggles with saving their hard-earned cash. In fact, debt has become a way of life for most of us, ensuring that our savings are eaten away by…

We’re not suggesting you cancel your Easter Egg Hunt plans, but you might want to stock up on those plastic eggs, just in case… The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or…

A very expensive game of chicken with the US Fed

We’re spending like there’s no tomorrow… We saved up a lot during the years of the pandemic, and now it appears we are spending it. Americans have begun financing their new spending habits with credit cards and draining their savings in recent months, as the cost of living soars. Some…

7 Ways to Reduce our Taxes

You’re paying em’, but can you pay less? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Delivering Financial Education

How Do You Want Your Financial Education Delivered? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

When is a bailout not a bailout?

If it walks like a duck then it’s probably a bailout… When is a bailout not a bailout? Let’s start in Silicon Valley with the biggest bank failure since the 2009 financial crisis. Silicon Valley Bank (SVB) was among the go-to banks for start-ups and biotech companies. It’s growth in…

How to achieve financial wellness

What the heck is financial wellness anyway? The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

The #1 reason that the banks will fail…

it’s your Nana The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Inflation is getting serious – it’s hitting our beer!

Now it’s getting out of control – this is beer we’re talking about… To The FED – Banks are 1 thing, but this my beer! Fed chief Jerome Powell did his part in helping to stem a banking crisis in March, but he hasn’t been able to halt another crisis…

Correction Again, Really?

Hey, Mr. (Fed) DJ – Can you play something else for a change? After a really lousy go of it last week the S&P 500 dropped into Correction territory…again. No, your radio isn’t busted, it’s just the Fed DJ has been blasting out the same old inflationary song for so…

Halloween wasn’t so scary after all

The projection was to spend a record 12.2 Billion (that’s a lot of candy…) And it just might bode well for things going forward from here… We told you last week that the S&P 500 had dipped into correction on Friday, 10/27. A seasonal run from the mid-year…

Got your Wayferers on?

The stock market is so bright that you’re gonna need to wear shades… The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Why is it so hard to get a cup of coffee?

When a (jobs) report doesn’t tell the whole story… The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Thought There Would Be A Safe Landing?

Now It Looks Like No Landing At All… The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

When being a passive investor can be too passive

The S&P 500 returned 26.34% last year The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

You’re Not Feeling So Good Right Now

And You’re Not Alone! The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

3 Paychecks This Month

This is a subtitle for your new post Here’s a look at when your three-paycheck months will be, based on when you received your first paycheck of the year. If you received your first paycheck of 2024 on January 5, you’ll receive three paychecks in March and August. March pay…

8 Money Makes to before the year ends

Completing these financial tasks before year-end can help set you up for financial success in the New Year. 1. Perform a cash flow checkup Compare your monthly spending amounts with the amount you expected to spend. Did you spend more, less, or about the same? Recommended viewing: SavingvsSpending 2. Shore up…

Surviving Black Friday Financially

7 Smart Shopping Tips for Black Friday The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Budgeting is just like trying to Diet

Why Trying to Budget is Like Going on a Diet (And Why It Often Fails) Budgeting and dieting are two of the most common self-improvement goals people set for themselves. Both aim to bring about positive changes—whether it’s financial stability or better health. However, many find that sticking to a…

Why Do Resolutions Fail by Mid-January?

How To Avoid The Quitters Day Trap Have you ever noticed how New Year’s resolutions seem to lose their sparkle by the second or third week of January? If so, you’re not alone. Statistics show that most people abandon their resolutions within a few weeks of setting them. But why…

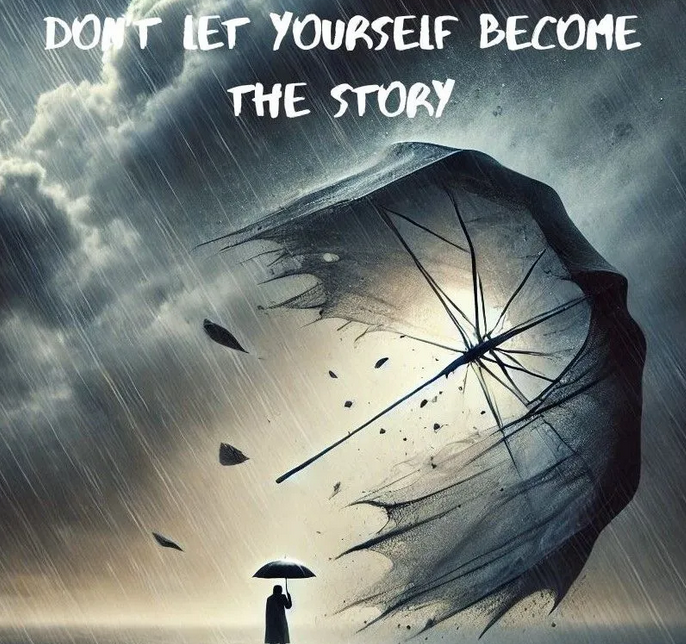

Don’t Let Yourself Become The Story

We’ve all known someone who this has happened to… Do you ever hear stories about people whose lives were turned upside down after a tragedy? Someone who became unexpectedly ill, suffered a disabling accident, or passed away without warning? Often, what follows is an all-too-familiar tale: a family left struggling…

Financial Challenges Face By Americans in 2024

Will 2025 Be Any Different? Financial Challenges Faced by Americans in 2024In 2024, Americans encountered numerous financial hurdles that affected their ability to save and manage their finances effectively. Inflation was a major concern, driving up the costs of essentials like housing, groceries, and utilities, which strained household budgets.Credit card…

The January Barometer and 2018: A Cautionary Tale for 2025 Amid New Trade Tensions

Introduction to the January Barometer The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Why the Cost of Eggs and Gasoline May Skew an Investor’s View of the Current Economy

Why the Cost of Eggs and Gasoline May Skew an Investor’s View of the Current Economy This is a subtitle for your new post IntroductionWhen it comes to assessing the economy, investors often look at key indicators like stock market trends, employment rates, and GDP growth. However, everyday expenses like…

Your Old Retirement Plan Called & Wants To Come Home

What Are The Options Available For Your Old Plan? Retirement planning is all about preparing for the future, but what happens when your old retirement plan from a previous employer is left hanging in the past? If you’ve changed jobs, you may still have an old 401(k) or another retirement…

Financial Challenges Face By Americans in 2024

In 2024, Americans encountered numerous financial hurdles that affected their ability to save and manage their finances effectively. Inflation was a major concern, driving up the costs of essentials like housing, groceries, and utilities, which strained household budgets.

Why Do Resolutions Fail by Mid-January?

Have you ever noticed how New Year’s resolutions seem to lose their sparkle by the second or third week of January? If so, you’re not alone. Statistics show that most people abandon their resolutions within a few weeks of setting them. But why does this happen? The reasons often lie…

Is 2021 Off To A Good Start?

If You Thought That 2020 Was Bad… You Would Think That 2021 Has It EasyLet’s face it – 2020 sucked; There was a global pandemic, quarantines, a market crash (and yes I can use that term as it was a more than 30% decline at one point), and most of…

The Markets This Week

The Financial Review for Week of January 11 THE WEEK ON WALL STREET Shrugging off COVID-19 infections and the disruption at the Capitol on January 6, stocks powered higher to kick off a new year of trading.The Dow Jones Industrial Average gained 1.61%, while the Standard & Poor’s 500 increased by…

Market Predictions – #trendcasting

US Treasuries Flashing A Warning Sign? Last night in our first Thirsty for knowledge Thursday of the New Year we the state of the state of the financial markets and where we see things headed from here. It was a little bit of looking back to see what’s ahead with a little…

#1 Retirement Question is the Wrong Question

WHEN? The #1 questions that is asked of anyone planning or thinking about retirement is “When do you want to retire” or it may be re-phrased as “At what age do you want to retire”. While this question is a consideration, it is definitely not the most important question to ask. That question is HOW? As in “How…

Speed Bumps on your Retirement Journey

There are plenty of potholes to avoid along your way… Once you have your figures & numbers firmed up, and you’ve poltted out a course for whn you will be retiring. The next step is to make sure that you will stay on course. And just like when you are…

What’s In Your Buckets?

The 3 Functions of Your Money in Retirement What’s In Your Buckets? When you are in retirement there are only three (3) things that your money is there to do; Generate Income Provide Liquidity Leave A Legacy That’s it! And I know this sounds simplistic, but the problem that most retirees…

Change Your Spending Habits

7 Steps to Change Your Spending Ways Here are 7 ways that you can impact the way your spend, or steps that you can take to help manage or change some habits you may developed when it comes to parting with your money: 1. CASH ONLYCredit, and especially ATM cards, make it…